CHANGES TO IRS SECTION 179: WHAT IT MEANS FOR FACILITY OWNERS

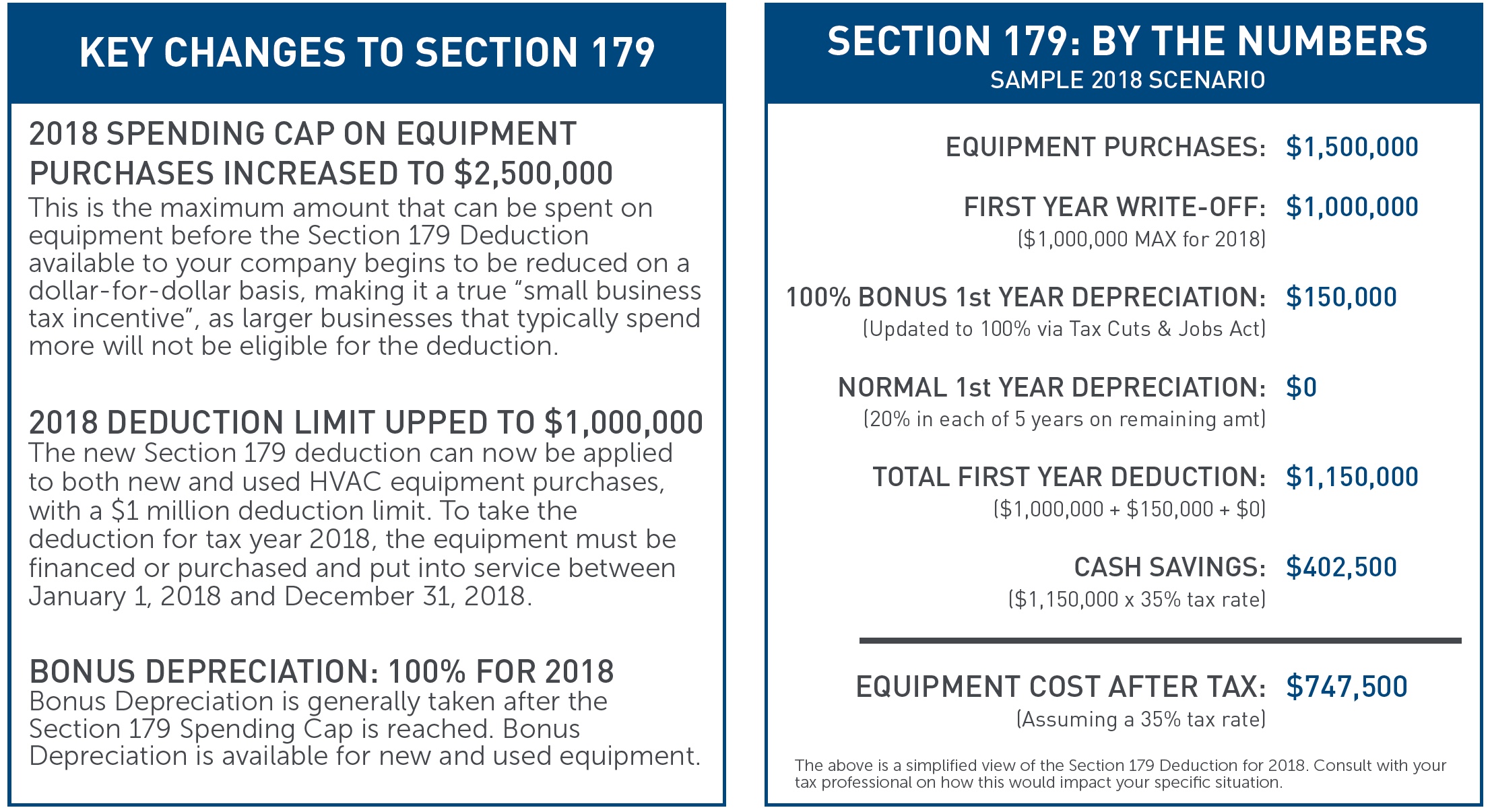

The Tax Cut and Jobs Act, signed into law in December 2017, brings positive changes to IRS Section 179 for 2018. These updates provide considerable savings for facility owners who invest now and take advantage of a deduction that drastically reduces their initial investment.

Prior to the 2018 changes, this special deduction for commercial facility owners was limited to mostly business-use vehicles and non-fixture equipment inside a commercial building, such as office equipment, machinery, computers, etc. HVAC has historically been considered a capital deduction and had to be depreciated over several decades, which was often longer that than life of the investment.

Millions of small businesses are taking action and seeing real benefits. Shouldn’t you?

SECTION 179 AT A GLANCE:

WHY IT’S SO CRITICAL TO ACT NOW

If your facility is in dire need of an HVAC overhaul, there is no better time than the present to move forward with much needed repairs, replacements and retrofits. Why?

DEPRECIATION AMOUNTS MAY BE REDUCED AFTER 2018

Tax implications under Section 179 have varied widely over the years – in 2007 the maximum deduction was only $125,000 – and there is no guarantee it will remain at the current maximum deduction of $1,000,000.

HVAC EQUIPMENT QUALIFIES FOR SECTION 179 FOR THE FIRST TIME – BUT IT MAY NOT LAST

While there are high hopes that HVAC equipment will continue to be a Section 179-eligible deduction for years to come, there are no assurances that it will remain on the list.

BOTTOM LINE:

NOW IS THE TIME TO MAKE THE FACILITY INVESTMENT AND MAXIMIZE YOUR TAX BENEFITS.

With tax savings at an all-time high under this code – and no guarantees that these major purchases would be Section 179-eligible in 2019 and beyond – there is no time to waste in getting your facility the critical updates it needs in 2018.

FOR MORE INFORMATION ABOUT TAKING ADVANTAGE OF SECTION 179 IN 2018, CONTACT US TODAY.

JAMIE JOHNSTON

Director of Business Development

jjohnston@airforceone.com

614.408.1738